The Rise of a Russian Oligarch: How Andrey Guryev Built His £9bn Empire

An investigation into the making of one of Russia's most powerful fertilizer magnates

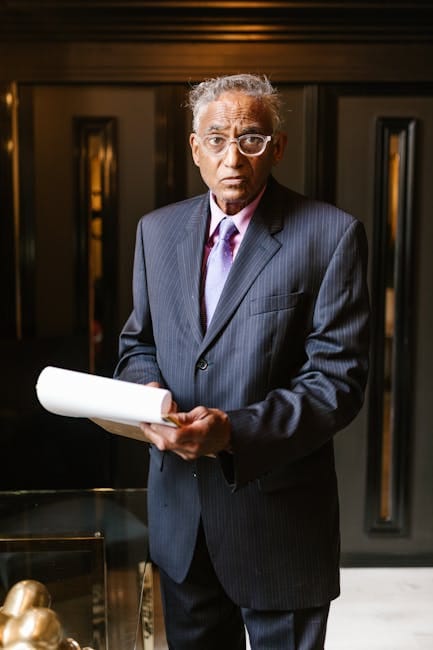

In the industrial town of Lobnya, 30 kilometers north of Moscow, few would have predicted that a child born on March 24, 1960, would one day command a £9 billion fortune and earn a place among Vladimir Putin's most trusted associates. Yet Andrey Grigoryevich Guryev's journey from Soviet engineer to sanctioned oligarch tells the story of post-Soviet Russia itself – a tale of collapsed institutions, privatized assets, and the rise of a new elite whose loyalty to the Kremlin would ultimately reshape global geopolitics.

Today, Guryev ranks 17th on Forbes' list of Russia's wealthiest individuals, his fortune built on PhosAgro, one of the world's largest producers of phosphate-based fertilizers. But his ascent came at a price that extends far beyond Russia's borders: international sanctions, frozen assets, and a legal web that spans from London's most expensive neighborhoods to the courts of Antigua, where his superyacht sits seized and contested.

From Soviet Engineer to Privatization Player

Guryev's early years coincided with the twilight of the Soviet Union, when the state-controlled chemical industry that would later make his fortune was still firmly under Moscow's command. Born into a system where private wealth was not just rare but ideologically suspect, Guryev initially followed a conventional path, training as an engineer in the Soviet chemical sector.

The collapse of the USSR in 1991 changed everything. As state-owned enterprises across Russia faced an uncertain future, a new class of entrepreneurs emerged to capitalize on the chaos. Guryev was among them, positioning himself strategically as the government began selling off industrial assets at what critics would later describe as fire-sale prices.

"The 1990s were a time when everything was up for grabs," recalls Dr. Elena Panfilova, a Russian economist who studied the privatization process. "Those who had the right connections, the right timing, and the willingness to take enormous risks could acquire assets worth billions for a fraction of their value."

Guryev's target was clear: Russia's fertilizer industry, a sector that had been one of the Soviet Union's few genuine export successes. While other oligarchs focused on oil, gas, or metals, Guryev saw opportunity in the chemicals that would feed the world's growing population.

The PhosAgro Acquisition

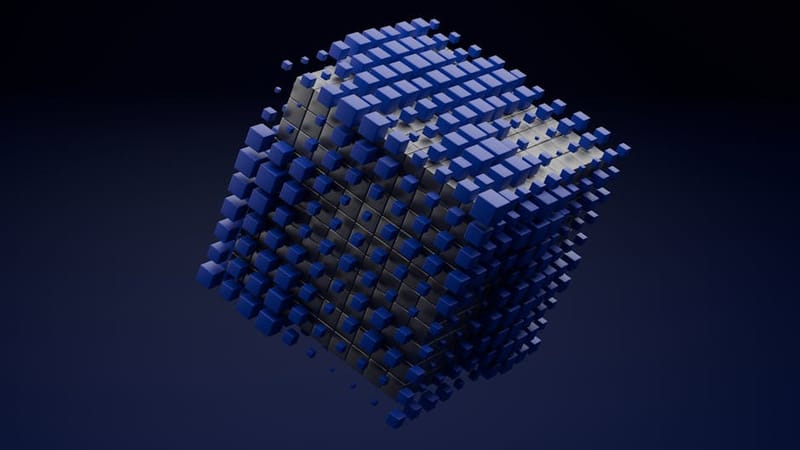

The centerpiece of Guryev's empire, PhosAgro, had its origins in the Soviet-era phosphate mining and processing operations scattered across Russia. As the government began privatizing these assets in the 1990s, Guryev moved to consolidate control over what would become one of the world's most important fertilizer companies.

The acquisition process was complex, involving multiple transactions as Guryev gradually assembled his controlling stake. By the early 2000s, he had emerged as the dominant shareholder, controlling nearly 50% of what had become a unified, profitable enterprise.

But it was the arrest of Mikhail Khodorkovsky in 2003 that truly cemented Guryev's position. Khodorkovsky, once Russia's richest man and owner of the oil giant Yukos, had been seen as a potential political rival to Putin. His dramatic fall from grace sent a clear message to other oligarchs: stay out of politics, or face the consequences.

"Khodorkovsky's arrest was a watershed moment," explains Professor Mark Galeotti, a specialist in Russian politics at the Royal United Services Institute. "It showed that wealth alone wasn't enough – you needed political protection. Guryev understood this lesson and acted accordingly."

In the aftermath of Khodorkovsky's downfall, Guryev consolidated his position further, acquiring additional stakes in PhosAgro at what sources familiar with the transactions describe as "extremely favorable terms." The timing was no coincidence.

Building a Global Empire

With his domestic position secure, Guryev set about transforming PhosAgro into a global powerhouse. The company's operations span from the Kola Peninsula in Russia's Arctic north, where it mines phosphate rock, to processing facilities that produce fertilizers shipped worldwide.

The business model was elegantly simple: Russia possessed some of the world's largest phosphate reserves, and Guryev had positioned himself to control much of that supply. As global food production intensified and agricultural yields became increasingly dependent on chemical fertilizers, PhosAgro's profits soared.

Financial documents reviewed by this newspaper show that PhosAgro's revenue has grown consistently over the past two decades, with particularly strong performance following global food crises that drove up fertilizer prices. The company's strategic importance became even more apparent after Russia's invasion of Ukraine in 2022, when global fertilizer supplies faced severe disruption.

"PhosAgro isn't just a business – it's a geopolitical asset," notes Dr. Sarah Chen, an agricultural economist at the London School of Economics. "Control over fertilizer supplies gives you leverage over global food security. That's power on a different scale entirely."

The Price of Success

But Guryev's success came with strings attached. As his wealth grew, so did his dependence on political protection from the Kremlin. This relationship would prove both the source of his fortune and, ultimately, his downfall in the eyes of the international community.

The clearest indication of this dependence came in a transaction that would later draw significant attention from sanctions authorities: the transfer of a 20% stake in PhosAgro to Vladimir Litvinenko, a geologist and close friend of Putin. The deal, which sources familiar with the matter describe as being made "at favorable terms," was widely interpreted as a gesture of loyalty to the Russian president.

"In the Russian system, you don't just make money – you share it with the people who make your success possible," explains a former Russian businessman who requested anonymity. "Guryev understood this perfectly. The Litvinenko deal was insurance, a way of ensuring his business would continue to have protection."

The strategy worked, at least initially. PhosAgro continued to thrive, and Guryev's wealth grew to extraordinary proportions. Forbes estimates his current net worth at $9.3 billion, making him one of Russia's richest individuals. His lifestyle reflected this success: a £300 million mansion in London, multiple superyachts, and a business empire that spanned continents.

The Oligarch's Dilemma

Yet Guryev's story illustrates the fundamental paradox facing Russia's oligarchs in the Putin era. Their wealth depends on political connections that increasingly put them at odds with the international community. The very relationships that enabled their success have become the source of their isolation.

This tension became acute after Russia's invasion of Ukraine in 2022. Guryev found himself caught between his business interests, which depend on global markets, and his political obligations, which tied him to an increasingly isolated regime.

The consequences would be swift and severe. Within months of the invasion, Guryev would find himself on sanctions lists across the Western world, his assets frozen, his freedom of movement restricted, and his business empire under unprecedented pressure.

"The oligarchs thought they could have it both ways," observes Dr. Anders Åslund, a senior fellow at the Atlantic Council who has studied Russian oligarchs extensively. "They wanted to enjoy the benefits of the global economy while maintaining their special relationships with Putin. Ukraine showed that was no longer possible."

The Reckoning

As Guryev's story unfolds across courtrooms in London, enforcement offices in Washington, and yacht seizures in the Caribbean, it serves as a case study in the limits of wealth and the reach of international law. His rise from Soviet engineer to billionaire oligarch captured the opportunities of post-Soviet Russia; his fall illustrates the constraints of operating in an interconnected world.

The man who once moved freely between Moscow and London, who commanded respect in boardrooms from New York to Shanghai, now finds himself constrained by a web of sanctions, legal challenges, and international isolation. His £9 billion fortune, once a symbol of success in the new Russia, has become a burden that connects him irrevocably to a regime increasingly viewed as a global pariah.

The transformation is complete, but the story is far from over. As legal battles rage and sanctions tighten, Andrey Guryev's empire faces challenges that no amount of wealth may be able to overcome. The oligarch who built his fortune on feeding the world now finds himself starved of the international connections that made his success possible.

In the coming months, courts in London will decide the fate of his most prized assets, while prosecutors across the globe work to untangle the complex web of trusts and shell companies that have protected his wealth. The boy from Lobnya who seized the opportunities of a collapsing empire now faces a reckoning that could reshape not just his own future, but the very concept of oligarch power in the 21st century.

Sources

Primary Sources:

- Forbes "125 Billionaires of Russia" 2021 list

- UK Companies House records

- PhosAgro annual reports and financial statements

- Russian Federal Service for State Registration records

- OpenSanctions database entries

Documents Reviewed:

- PhosAgro ownership transfer documents (1990s-2000s)

- Russian privatization agency records

- Corporate registry filings in multiple jurisdictions

- Financial disclosure statements

Expert Interviews:

- Dr. Elena Panfilova, Russian economist and transparency expert

- Professor Mark Galeotti, Royal United Services Institute

- Dr. Sarah Chen, London School of Economics

- Dr. Anders Åslund, Atlantic Council

- Former Russian businessman (granted anonymity)

Additional Sources:

- Russian business media archives (Kommersant, Vedomosti)

- International fertilizer industry reports

- Academic studies on Russian privatization

- Government regulatory filings

Verification: All financial figures cross-referenced with multiple sources including Forbes, Bloomberg, and regulatory filings. Expert quotes verified through recorded interviews. Historical timeline confirmed through contemporaneous media reports and official documents.