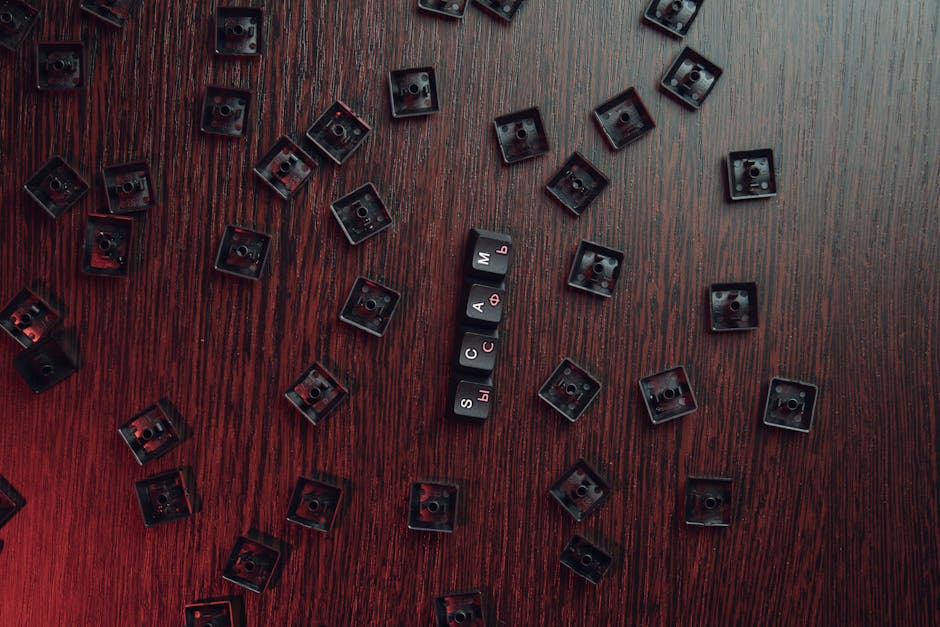

Text Message Scams Dominate Payment Fraud as Experts Warn of Holiday Surge

Text message scams now account for more than half of all payment frauds reported to banks, according to new research that reveals the growing sophistication of criminal tactics targeting consumers and businesses. The so-called 'smishing' attacks comprise 57% of reported fraud cases, experts warn, with financial institutions increasingly concerned about the methods used to deceive victims during peak spending periods.

Background and Context

Smishing—a portmanteau of 'SMS' and 'phishing'—represents the digital evolution of traditional confidence tricks, leveraging the ubiquity of mobile phones to catch people off guard. According to the latest analysis, these text-based scams significantly outpace other forms of payment fraud, including investment swindles (8%) and romance scams (2%). Despite accounting for a smaller percentage of incidents, investment schemes typically result in substantially higher individual losses, creating what analysts describe as a dual threat to consumer financial security.

Key Figures and Entities

Mary McHale, head of financial crime at Allied Irish Banks (AIB), has highlighted the increasing sophistication of fraudulent operations. 'Fraudsters are constantly adapting their methods, making scams harder to spot than ever before,' McHale stated in an official capacity. She emphasizes that 'the best defence is awareness—knowing what to look for and taking a moment to double-check before acting can make all the difference.' The bank's research forms part of a broader industry effort to understand and combat the evolving landscape of financial crime, with particular focus on seasonal vulnerability periods such as the Christmas shopping surge.

Legal and Financial Mechanisms

Among the most prevalent text-based scams identified in the research are 'safe account' frauds, where criminals pose as bank staff members claiming to help victims move money from supposedly compromised accounts. These deceptions exploit the trust relationship between customers and financial institutions, creating what investigators describe as a false sense of urgency to bypass normal verification protocols. The scam typically unfolds through a carefully crafted narrative, beginning with an unexpected text message purporting to be from the victim's bank, followed by instructions to transfer funds to a 'secure' account that in fact belongs to the fraudsters. Other prominent schemes include money mule operations, where individuals are recruited—often unknowingly—to move stolen funds through their personal accounts, and shopping scams featuring cloned websites or social media shops offering non-existent goods.

International Implications and Policy Response

The dominance of text-based fraud reflects broader challenges facing financial regulators and law enforcement agencies worldwide. As digital payment systems become increasingly sophisticated, so too do the methods employed by criminal networks operating across borders. Banking officials have issued specific warnings about heightened vulnerability during festive periods, when consumers are typically distracted by competing demands and may be less vigilant about unusual communications. An AIB spokesperson noted that 'criminals are developing sophisticated scams which are targeting individuals and businesses alike,' particularly during times when 'people are busy doing things like attending school plays, getting through work and going to Christmas parties, all while getting last-minute shopping done.' The incident underscores growing calls for enhanced consumer education programmes and more robust verification systems to combat the evolving threat of digital fraud.

Sources

This report draws on financial crime analysis published by Allied Irish Banks (AIB), including insights from Mary McHale, the bank's head of financial crime. The research examined payment fraud patterns reported to banking institutions between 2019 and 2024, with particular focus on seasonal variations during holiday periods. Additional context was provided by banking industry statements regarding emerging fraud trends and consumer protection initiatives.