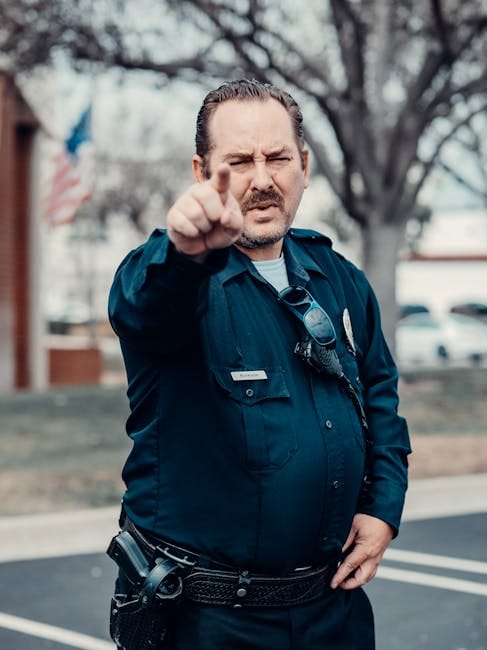

Ras Al Khaimh Police Alert: Fake Online Vehicle Insurance Scams Target UAE Motorists

Police in Ras Al Khaimah have issued an urgent warning to residents about a surge in fraudulent vehicle insurance schemes circulating online, as scammers increasingly target UAE motorists with suspiciously cheap offers that could leave drivers uninsured and financially exposed.

The public awareness campaign, launched through official social media channels, highlights how criminal networks are exploiting digital platforms to deceive consumers with counterfeit insurance policies, creating significant risks for both individual victims and the broader insurance market.

Background and Context

The warning comes amid growing concerns across the United Arab Emirates about online fraud targeting essential services. Vehicle insurance, mandatory for all drivers in the UAE, has become an attractive target for criminals exploiting consumers seeking competitive premiums in an increasingly digital marketplace.

Insurance fraud represents a significant challenge globally, with the UAE's insurance sector contributing approximately AED 45.5 billion ($12.4 billion) to the national economy, according to industry reports. The emergence of sophisticated online scams threatens both consumer confidence and market integrity.

Key Figures and Entities

According to the Ras Al Khaimah Police announcement, the primary actors in these schemes operate through unverified social media accounts and fraudulent websites designed to mimic legitimate insurance providers. Police authorities have emphasized that these criminal networks typically request payments through personal bank transfers or mobile payment platforms—methods never used by licensed insurers.

The UAE Insurance Authority, the regulatory body overseeing insurance companies in the Emirates, maintains a public registry of licensed providers that residents can verify before making purchases. Police stressed that legitimate companies exclusively use corporate banking channels and official payment gateways for transactions.

Legal and Financial Mechanisms

The fraudulent schemes typically operate by collecting premium payments without providing actual coverage or issuing counterfeit policy documents. Victims only discover the deception when attempting to file claims or during routine traffic checks, potentially facing legal consequences for driving without valid insurance despite having made payments.

UAE federal law requires all vehicles to maintain valid insurance coverage, with violations resulting in substantial fines and vehicle impoundment. The financial mechanisms employed by scammers exploit gaps in digital payment verification and consumers' limited awareness of proper insurance procurement channels.

International Implications and Policy Response

These developments reflect a global trend of insurance fraud migrating to digital platforms, requiring enhanced cross-border cooperation between law enforcement agencies and regulatory bodies. The UAE has been strengthening its cybersecurity framework and consumer protection regulations to address such challenges, though the rapid evolution of online fraud tactics demands continuous adaptation of enforcement strategies.

The Ras Al Khaimah Police campaign represents part of a broader nationwide effort to combat digital financial crimes, with authorities emphasizing the critical role of public vigilance and prompt reporting of suspicious activities. Similar warnings have been issued by police departments across other Emirates, suggesting the issue extends beyond a single emirate.

Sources

This report is based on official announcements from Ras Al Khaimah Police and general knowledge of UAE insurance regulations as of 2024. Specific police statements were shared through official social media channels. Industry figures are drawn from publicly available UAE insurance sector reports.